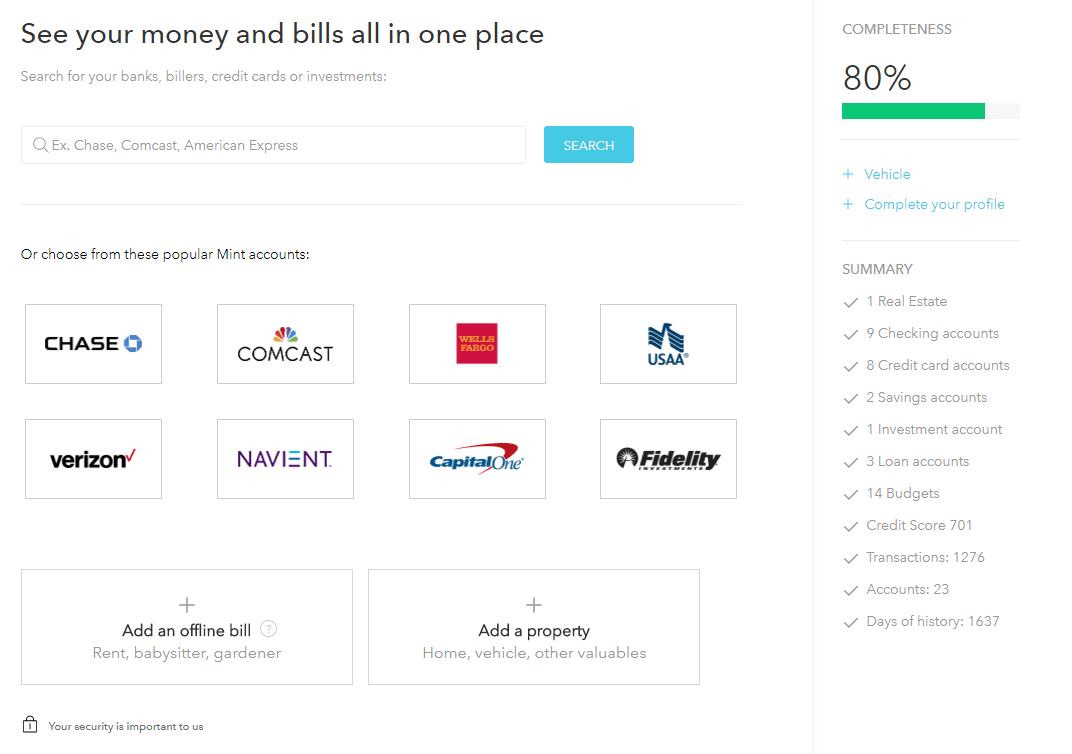

Looking to take control of your finances and start planning your path to financial freedom today? Check out The Financial Freedom Blueprint ® Course! Quicken Both apps will also show you your credit score and will send you emails or texts with updates regarding your finances. You can link credit cards, bank accounts, loans, and investment accounts, and synchronize everything onto one platform.īoth apps can be used on computers, smartphones, and other smart devices. That way, you can look at all of your financial needs and budget accordingly. Quicken and Mint Platform Featuresīoth Quicken and Mint allows you to link all of your financial accounts to the app so that all of your information is in one place. Let's look at them side by side and compare them with each other. The biggest difference between them is that Mint is free, while Quicken has a cost.ĭoes that mean you should choose Quicken because that fee means it's a better program? Not necessarily. They are similar, but each one has its own strengths.

Quicken mint com software#

Mint and Quicken are two very popular budgeting software systems. Let's take a closer look at both of these great budgeting apps.

However, both can be extremely helpful and keep your finances organized. Mint is free, while Quicken will cost you a small fee. Mint and Quicken are perfect examples of these tools. Some of these tools don't cost anything, but some can still really benefit you for only a small fee. We recommend you consult with a financial or tax advisor when making contributions to and distributions from an IRA plan account.Modern budgeting tools simplify managing your money. Required minimum distribution, if applicable, is only relevant to this IRA plan and does not take into consideration other IRA plans held at American Express or other institutions. IRA distributions may be taxed and subject to penalties based on IRS guidelines. §IRA Contributions are subject to aggregate annual limits across all IRA plans held at American Express or other institutions. The first recurring deposit is assumed to begin in the second period after any initial deposit. Actual results may vary, based on various factors such as leap years, timing of deposits, rounding, and variation in interest rates. ♢Calculations are estimates of expected interest earned. Transfers can be initiated 24/7 via the website or phone, but any transfers initiated after 7:00 PM Eastern Time or on non-business days will begin to be processed on the next business day. ‡For purposes of transferring funds, business days are Monday through Friday, excluding holidays. However, please note that there are strict rules for withdrawing money from an IRA plan (including an IRA High Yield Savings Account) before retirement age without incurring a penalty. †You are generally permitted to make up to nine (9) withdrawals or transfers out of your High Yield Savings Account during a monthly statement cycle. **The national rate referenced is from the FDIC's published Monthly Rate Cap Information for Savings deposit products. Please see the Deposit Account Agreement for additional terms and conditions and Truth-in-Savings disclosures.

Early CD withdrawals may be subject to significant penalties which could cause you to lose some of your principal. After a CD is opened, additional deposits to the account are not permitted. Your rate will be fixed on the business day‡ we receive your completed application, provided we receive your deposit within 30 days after your application is approved. Interest rate and APY are subject to change at any time without notice before and after a High Yield Savings Account is opened.įor a CD account, rates are subject to change at any time without notice before the account is opened. *The Annual Percentage Yield (APY) as advertised is accurate as of.

0 kommentar(er)

0 kommentar(er)